FLEXIBLE PAYMENTS FOR FLEX DRIVERS

PROJECT OVERVIEW

Amazon Flex is a flexible delivery program that allows independent drivers/contractors (also known as “Delivery Partners” or “DP”) to deliver various Amazon orders using their own vehicles and earn extra money.

For this project, the design team was looking to overall improve the payments experience for drivers by focusing on two main areas within onboarding: payment frequencies and improving disbursement speeds with different payment types.

PROBLEM/ASK

Drivers were currently getting paid Tuesdays & Fridays weekly

The only current offering for payments was directly connecting their bank accounts

Offer flexibility for drivers to select their payment days or frequencies

Improve disbursement speeds by offering different payment types

Create an intuitive onboarding UI for entering payment information

GOALS

These features will take us one step closer to match other gig company payment offerings (DoorDash, Uber Eats, etc.)

These features will also put us on track for long-term goal to offer Instant Payments to Flex Drivers

USERS

Amazon Flex drivers who have onboarded within the last 30 days. We were able to target these users by querying their start dates in our database.

This will give us a set of users who were most familiar with onboarding and entering their information such as payment methods.

We want to understand how will faster/flexible payment impact these users

RESEARCH QUESTIONS

Critical research questions our UX research team was looking to address:

Primary question: What payment frequencies make sense and are desirable?

Helps us understand the what works with best with how drivers operate their expenses outside of work

Primary question: What payment options do drivers prefer and are willing to utilize to have their funds deposited?

Helps us understand if drivers prefer speed within payments and also be competitive with other companies

Secondary Question: Do users understand what is going on? What do they expect to happen in certain instances of the editing payment methods/frequencies?

Helps us understand if new prototypes are intuitive and understandable to drivers with new offerings

RESEARCH METHODS

Usability Testing

Generates valuable qualitative & actionable insights that will inform us what people do with the new prototypes and UI adjustments that need to be made

Complete a series of usability tasks with new payment onboarding prototypes (behavioral data)

Due to environment constraints, this usability will be performed in a modified fashion where the I present the driver with a task and the driver will tell me where to click within the prototypes

User Interviews

Generates valuable qualitative insights that will inform us what our drivers currently think or feel about the changes

Ask Flex Drivers directly about their preferences/feedback when completing tasks and throughout the session (attitudinal data)

MY ROLE

Recruit & schedule qualified drivers

Conduct individual interviews with qualified drivers

Facilitate usability test on proposed flows from design team

Synthesize key data points and make strategic recommendations to design team

FINDINGS/RECOMMENDATIONS

-

What payment frequencies make sense and are desirable?

What payment options do drivers prefer and are willing to utilize to have their funds deposited?

-

Drivers did not have a strong preference of payment days. Recommendation: Provide an experience that presents a standard but also provides flexibility based on preferences.

Drivers largely prefer using their own bank account. Recommendation: Keep UI as is with an option for debit cards

9 drivers participated in research sessions and ran through usability tests testing out new features focused on flexible payment options/frequency while onboarding. The initial target audience for this testing was Amazon Flex drivers who have onboarded within the last 30 days. Due to lower response rates, we pivoted slightly and met with a mixture of folks with some being with Flex for several years and others who onboarded within the last 6 months. Drivers were presented with onboarding scenarios and tasks in areas such as applying for the Amazon Flex debit card, setting/editing their payment frequency and changing their payment methods.

Key themes from this research include:

Drivers considered the idea of the applying for Amazon Flex debit card which allowed them to receive instant payments without fees but majority were still comfortable using their own bank account

Drivers generally preferred a single day for payment or split payments over two days

Drivers were able to complete the tasks and understood what actions were expected

Drivers considered the idea of the debit card but majority were still comfortable using their own bank account

Drivers were presented with a task to begin entering their payment information as part of their onboarding. They were presented with two options – Apply for the Amazon Flex Visa Debit Card or Use a Bank Account. Drivers generally preferred using their own bank account mainly due to the integration it has within the rest of their lives. Several drivers mentioned using their bank account in this case produced a feeling of comfort/security that their money is being deposited in one place and is available to use in other aspects such as bill payments, transfers, etc. without further change.

When asked if they would be willing to apply for the debit card:

Feedback about the benefit offerings were generally positive and drivers mentioned they were competitive with other cards

Some drivers mentioned that before applying they would prefer doing some informational research of their own and compare reviews from current card owners

Some drivers reported that they would like to know up front about any fees for deposits, transfers, etc.

A couple of the drivers already owned the debit card but their direct deposit was still set to their bank account

When asked if they would prefer entering a non-amazon debit card which required a fee for deposits:

Some drivers were okay with the fee and would pay it to receive their payments

Some drivers questioned why they were being charged and said it would deter them away from using a 3rd party or personal debit card. They also mentioned that they would adjust their frequency to 1 day if that was the case

Drivers generally preferred a single day for payment or split payments over two days

Drivers were presented with a payment frequency page after going through the debit card application process. Upon being asked their preference on payment days, there was a mixture of responses but they remained between either a single day payment or split payment over two days. Several of the drivers were accustomed to getting paid the standard Tuesday and Friday and didn’t see a need for change. Some drivers however were open to change and would prefer switching to a single day payment.

Key takeaways:

Drivers generally preferred working a couple days and then getting paid. This allows them to receive slightly larger amounts in their deposits

The Tuesday & Friday standard that Amazon flex payments are currently set to works well for a majority of the drivers

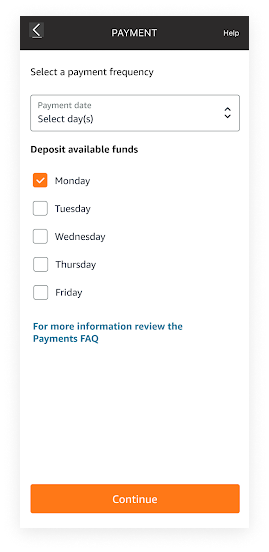

There seemed to be some slight confusion on what the dropdown menu was for and some of the drivers did not notice that you could interact with it. Drivers understood you could select the checkboxes for each day that you preferred

Drivers were able to complete the tasks and understood what actions were expected

Throughout most of the sessions, drivers understood what certain actions did in the app, where information needed to be entered and what the error messages meant.

Some areas of confusion:

On the screens where you can review the payment information and frequency entered while onboarding, drivers tended to look for a submit button to move on to the next step in the process. It was not clear to them that there was a back button that could take you back to a “steps to complete” page.

When receiving the payment or application denied error messages, some drivers mentioned they would want to know in the message why their application was denied or payment method was rejected.

There was some slight confusion between the amazon debit card and 3rd party debit card. Drivers were sometimes not aware that they were entering a 3rd party debit card until they saw the statement regarding fees for deposits.

ADDITIONAL FINDINGS

Location of payment/frequency edit page after onboarding

Several drivers reported that in their app the current payment information is located in Settings – Personal Information. When asked where they would like to see the new edit payment/frequency page, they reported the following options:

Add it into in the same location: Settings – Personal Information

Under “Earnings”

A separate section that contains all payment related information

Recommend to add to where current payment information is under settings OR combine payment/frequency/earnings into a central section within the app and test out a new flow if possible.

Select day(s) dropdown not noticed

Drivers were unaware or did not interact with the dropdown menu. Since the menu was already set to “Select day(s)”, drivers mainly reported which days they would prefer and understood the checkboxes could be selected.

Recommend further testing of this dropdown feature or simplifying to only days of the week

Adding more information to debit card application page

Recommend to add more information about fees and deposits in apply now or FAQ pages as many drivers had questions regarding these factors.

Naming for cards or accounts

A unique feature a driver mentioned was adding the ability to add nicknames to cards or accounts they entered so it is easier to refer to while onboarding or post onboarding

RESULTS

Shared by the Principal PMT on the Payments Team:

What was launched?

On 11/18, we launched Flexible Payments to US, SG and IN DPs and Push to Debt Payments to all US DPs. Both of these features play a critical role in our goal to improve the overall DP payment experience by improving both ‘payment frequency’, as in how often we finalize and issue payment to a driver after work is completed, and by improving ‘disbursement speed’, as in the speed at which funds are deposited to a DPs bank account after the payment is issued.

Flexible Payments: With Flexible Payments, DPs will now have an option during onboarding or post onboarding to select their payment days, including weekends and holidays in SG and IN (Sun-Sat) and all business days in US (Mon-Fri). If a DP chooses to get paid on all days, they will receive their payment on the Next Business Day in US and Next Day in SG and IN for earnings finalized on the previous day.

Push to Debit Card Payments (PTD): This feature will allow DPs to receive their payments to any US issued debit card including the Amazon Flex branded debit card issued by Green Dot. DPs will have the option post-onboarding (available in the settings menu) to set their debit card as their primary payment method in addition to the current checking and savings account direct deposit options. DPs who elect to use PTD will receive their funds within 30 minutes after we send payment instructions to our bank, typically between 4-8 AM PT on their selected payment days compared to a traditional checking or savings account which is received by the end of the day. Payments sent to Amazon Flex branded debit cards will be free of charge (vs. $0.50 for PTD to 3P non-GDOT debit cards), and bring additional value for Amazon Flex debit card holders, thereby incentivizing further engagement with the Flex Rewards program. Also, Flex is the first business in Amazon to offer debit card payments to external vendors.

Together, these features will take us one step closer to other gig company payment offerings or better in some cases as we are the first gig delivery company to offer free daily payments to all drivers with a US bank account.

Why is this launch important?

As ~30% of DPs rely on Flex earnings as their primary source of income, depositing DP earnings quickly and accurately is critical for the Flex Program. It’s also important to provide DPs with the flexibility to select their payment days. Whether DPs prefer once a week lumpsum payments to better manage their costs and finances, or if they prefer more frequent payments to meet daily operating expenses, DPs now have the choice to be paid as many or as few days as they choose. PTD will allow DPs to be paid earlier in the day, which will help DPs to meet their operating expenses to execute Flex blocks (e.g., gas) or to meet their end needs. PTD provides DPs with another payment channel for faster payments and will also unlock our long-term goal to offer Instant Payments to Flex Drivers, putting us at par or better than the rest of the gig economy.